Avoiding Payment Delays at Online Transactions

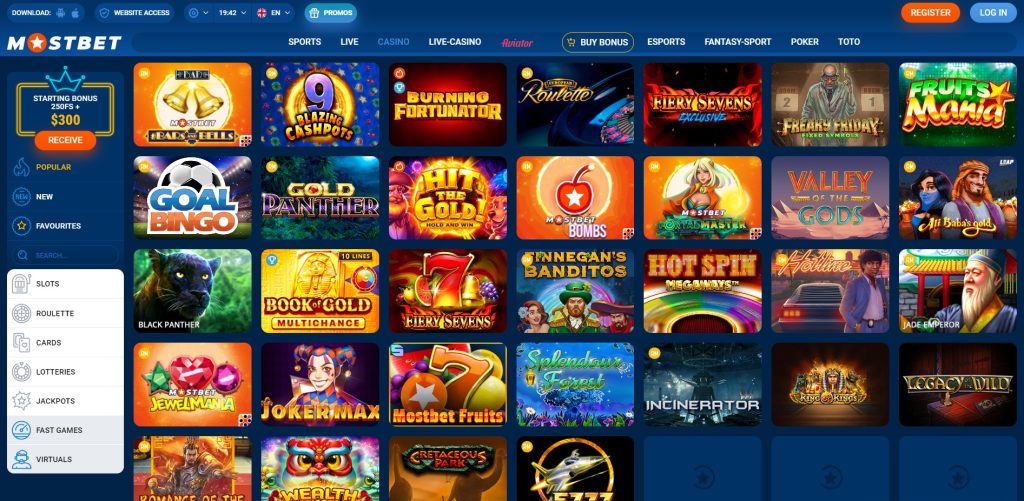

In today’s fast-paced digital economy, making payments online has become a routine part of our lives. From purchasing goods and services to sending money to friends or family, the convenience of online transactions is undeniable. However, payment delays can often mar this convenience, causing frustration and potential issues in various scenarios. To help mitigate these delays and ensure that your online monetary exchanges go smoothly, here are some essential tips. To get started, check out Avoiding Payment Delays at Online Casinos in Azerbaijan Mostbet tj for a seamless gaming experience.

Understanding Payment Delays

Payment delays can occur for various reasons, including technical issues, network problems, discrepancies in transaction details, or security verifications. Understanding these factors is the first step in avoiding delays.

1. Choose Reliable Payment Methods

One of the simplest ways to avoid payment delays is to choose a reliable payment method. Options like credit cards, e-wallets, and established payment gateways (like PayPal, Stripe, or Square) typically have robust systems that can handle transactions quickly and securely. Always check if the payment option you are using has a good reputation for timely processing.

2. Keep Your Payment Information Updated

Ensure your payment information, including credit card details, billing address, and contact information, is up-to-date. Incomplete or outdated information can lead to payment processing issues, causing delays. Regularly review your payment settings on all platforms you use to ensure accuracy.

3. Monitor Network Connectivity

A stable internet connection is critical when processing online payments. Unexpected disruptions in connectivity can lead to transaction failures or delays. Before making a payment, ensure that your device has a reliable internet connection, whether it be through Wi-Fi or mobile data.

4. Verify Transaction Details

Before hitting the ‘submit’ button, double-check all transaction details, including the amount, recipient information, and any reference numbers. Simple mistakes can lead to payment errors that may delay processing. Verifying all details before proceeding can save you from unnecessary headaches.

5. Use Two-Factor Authentication

Many payment platforms now offer two-factor authentication (2FA) as an added security measure. Enabling 2FA can not only enhance your account’s security but may also lead to quicker verification processes, minimizing delays caused by security checks. It’s a worthwhile investment in both security and efficiency.

6. Be Aware of Transaction Limits and Fees

Many payment methods come with transaction limits and potential fees that could slow down your payment process. For example, some services may require additional verification for larger transactions, resulting in delays. Always check the specifics of your payment method beforehand to avoid surprises.

7. Choose Optimal Times for Transactions

Some payment services may experience heavier traffic during specific times, which can limit processing speed. If possible, try to schedule your transactions during off-peak hours when servers are less busy. This can significantly reduce the likelihood of delays in processing your payment.

8. Contact Customer Support When Necessary

If you encounter a payment delay, do not hesitate to reach out to customer support for the payment platform you’re using. They can provide insights into what may be causing the delay and help you resolve any issues directly. Having a list of support contacts for your chosen payment services can be valuable to expedite this process.

9. Regularly Review Your Financial Statements

Monitoring your financial statements can help you catch any anomalies or unauthorized transactions early on. This vigilance can also ensure that you’re aware of any recurring payments or subscriptions that may be pending and prevent unnecessary payment delays.

10. Consider Using Payment Scheduling

For recurring payments, consider using payment scheduling options that many services offer. This way, transactions are processed on a specific date each month, reducing the likelihood of missed payments due to forgetfulness or cash flow issues.

Conclusion

Avoiding payment delays at online transactions is all about adopting best practices and being proactive. By choosing reputable payment methods, keeping your information current, and monitoring the network conditions, you can significantly enhance the likelihood of a smooth payment experience. Remember, staying informed and vigilant is the key to ensuring that transactions are completed efficiently.